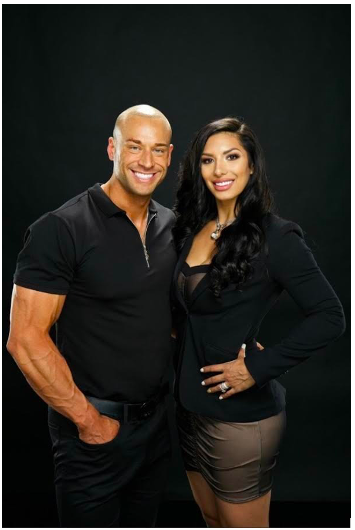

Chris Groves might be as close as you get to the definition of “self-made”. Growing up in a small town in Wisconsin, he had little opportunity around him to grow into the entrepreneur he is today. He had no help, guidance, not even a single dime loaned to him to get where he is today. Instead, he has relied on his own hard work, self-discipline, and time management skills to be as successful to the level he wanted. Now, he’s proud to be only in his early 30s and running the fastest growing mortgage company in the United States.

As the owner and CEO and Groves Capital, Chris certainly has his hands full. Groves Capital is a residential and commercial lending company in close to 20 states. They are proud to be a team of 185 loan officers and 65 processors.

“We are family owned and operated and virtual, which means we pass the savings to our clients,” Chris says.

Chris was no stranger to real estate when he decided to take the plunge into starting his own business. After working in the industry for many years, he began to notice a change in the field – it was moving online. With things turning virtual, Chris knew he had to respond to the evolving industry if he wanted to succeed.

“Mortgage requires more of a strategist mindset which isn’t easy to accomplish online; it requires more hands on and creative thinking. My goal was to create a platform for long term partnership, which, in short, means changing as the market and economy changes to be the best fit for our partners. The best number wins bottom line, and we are proud to have the best rates and products for our customers,” Chris outlines.

Despite his incredible success, Chris admits that there are a lot of obstacles on the path ahead. Namely, and especially for a new business, Chris reveals that reputation is a key element that is difficult to achieve.

“Gaining trust from people to join you from the start takes energy, confidence and the bravery to try a new way of doing things. We modify our systems almost daily to give our loan officers solutions. The tough part is learning how to scale it, to keep the same level of service as we grow. So we have focused on growing our support team as we grow our loan officers partnership. In this way, we overcome the biggest challenge of growing an amazing reputation with a 5 star reputation that people can trust,” Chris says.

To make it through the hardships, Chris focuses on his mindset to keep his head clear and motivated. Well-known for his ability to put a positive spin on any situation, Chris wholeheartedly believes that a positive attitude is the key to success.

“I always see the glass half full,” Chris says.

With the proper mindset, Chris believes that new entrepreneurs will be able to make the sacrifice needed to start their own business. After all, success is tied to individual work ethic.

“You will have to sacrifice your time, your friends, and your family at times. It will be difficult. Often, you will be running on fumes, but if you keep pushing the rock up the hill, once you get to the top, you realize it was all worth the effort. The bottom line is that you need to take responsibility for your actions or lack of actions. You can’t blame everyone else if things don’t go right – your happiness and your success is on you as an individual,” Chris says.

When Chris was young, his father told him that he was proud to give him a good work ethic. With that, he didn’t need a strong family name or a family loan. The irony is now, the Groves name does mean something with the company Chris has built around it.

“I recently reminded my father of this statement. I relayed that I always stuck with me and pushed me to grow Groves Capital. I told my dad our name means hard work, and without it, I would have never achieved my greatest achievement. Reputation means everything to me, if I say I’m going to do something I always do it,” Chris says.

Chris is available on Instagram. Take a moment to check out Groves Capital and all they have to offer on their website.